In this era of low oil prices, it is no surprise that project owners are looking for ways to increase productivity and cut capital costs in every safe way they can. One way that project owners have tried to cut costs is by sourcing their fabrication of steel overseas, to areas that have a lower initial cost. But when you consider the Total Installed Cost (TIC), which includes the fabrication and pre-assemble overseas, the subsequent delivery of that steel, and the supply cost, is it really the cheaper and more efficient option? That was exactly the subject of a market test back in 2013.

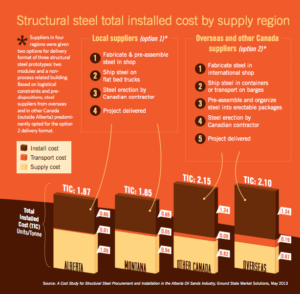

James Wootton, of Ground State Market Solutions, compared the costs of out-of-province and offshoring fabrication to Alberta-based fabrication and his results may surprise some project owners! What he found was that the TIC when using Alberta steel fabricators was cheaper than the out-of-province or overseas options. A summary of his data:

Now, the study occurred 2 years ago, so what has changed since then? Well, we were lucky enough to catch up with James and ask a few follow up questions to his 2013 study!

Q: Thanks for taking the time to sit down and answer some of our questions, James. Could you give a brief introduction to those that may not know you or your work?

A: Ground State Market Solutions is a research & consulting organization providing advisory services to investor groups, owner organizations, and contractors, with the unique advantage that we synthesize real time / high quality industry data to produce comprehensive research packages that can be tailored to a specific client’s requirements.

Q: Your 2013 study showed that Alberta based manufacturing & fabrication is the cheaper option for the oil sands, why is that?

A: Ultimately, it came down to a comparison of additional installation labour units versus extra-provincial supply and transport costs for the structures selected for the study, which were typical structures used in the oil sands. Other procurement options exist, but we thought at the time it demonstrated that comprehensive research was required to assess the value proposition associated with extra-provincial strategies.

Q: Is that still the case in today’s low price per barrel oil market?

A: That’s an interesting question. Our perspective would be that the decline in the price of oil has a lot to do with the Federal Reserve’s hawkish stance. This was originally messaged to the market last August and had a great impact on both the US dollar and speculative commodity trading. So, we’re in a compressed margin market that requires capital expenditure solutions. The outcome is that China in particular becomes more challenged as a region from which to procure steel given its peg to the USD. Not to mention the near 30% elevation in value versus the Canadian dollar.

The labour installation items are being addressed by some EPCs with innovative ‘end connection’ designs. But, as noted in the study, the difference is substantial, requiring a 20% lift in labour productivity to be net neutral at the exchange rate at the time. Given the currency differential today, a 35% productivity lift would be required.

We haven’t seen the results as yet from new fabrication and delivery formats, so it is difficult at this point to comment on how competitive that solution is, but the math of our study demonstrates the significance of the challenge.

Moreover, the first principles of value creation and project management remain the same, and we hoped more than anything that the study would prompt constructive questions and dialogue within project teams. Do we really understand the first principles of complex project systems, and how discrete procurement decisions are affecting overall project value?

Q: In the two years since your study, have oil sand project owners started to catch on to the lower cost of Alberta manufacturers?

A: In the November / December 2015 timeframe we surveyed ten project firms to assess sentiment / rationale per extra-provincial procurement and found the market was divided on the topic. Both camps were focused on value enhancement, while one camp seemed to be chasing the proposed extra-provincial savings, and the others were focused on execution efficiency and holistic procurement analytics.

Q: What have you found to be the general response to your findings?

A: It has been well received. It’s encouraging to be involved in the progressive value based dialogue we’ve had with our clients since we completed the study.

Q: Is there anything else you would like to add?

A: Productivity is paramount for all entities involved in project development.

Harry Neale once remarked, after a losing season behind the bench of the Vancouver Canucks,

“Last season we couldn’t win at home. This season we can’t win on the road. My failure as a coach is I can’t think of any place else to play.”

If project teams are challenged to create value with either local, or extra-provincial procurement solutions, the project pipeline will dry up.

At the time of the study, we made the point that Alberta was the most expensive place in the world studied to fabricate steel (supply only), even when accounting for format of delivery differentials. However, we thought there was ample room for productivity improvements.

It has been inspiring to see fabricators with the Alberta entrepreneurial spirit, find new operating models during this downturn to enhance productivity. That type of leadership and mature progression goes a long way to securing a prosperous business environment for the province going forward, and one that is less vulnerable to oil pricing shocks.